Company Registration and GST Registration in Delhi Made Easy for You

Are you an aspiring entrepreneur in the bustling metropolis of Delhi? Or perhaps you already run a business and are looking to expand your horizons? In either case, understanding the importance of company registration and GST registration in Delhi is paramount for your success. In this blog, we will walk you through the process of both registrations in simple English, ensuring you can navigate the bureaucratic maze with ease.

Company Registration in Delhi: A Fundamental Step

Starting a company in Delhi, or anywhere in India for that matter, begins with company registration. This crucial step formalizes your business and offers you a distinct legal identity. Here is how you can get started:

Choose a Business Structure: The first decision you need to make is the type of business structure you want. In India, you can opt for a Private Limited Company, Limited Liability Partnership (LLP), Sole Proprietorship, or Partnership. Your choice will depend on factors such as liability, ownership, and the scale of your business.

Name Reservation: After deciding on your business structure, you need to propose a unique name for your company. The Registrar of Companies (RoC) will approve it after verifying its availability.

Obtain Digital Signature Certificate (DSC) and Director Identification Number (DIN): To file for company registration in Delhi, you must obtain a DSC for online transactions. Directors also need a DIN.

Prepare Documents: Collect the necessary documents, which include identity and address proofs, utility bills, and rental agreements (if applicable).

Filing Forms: You must file the required forms with the RoC, such as the SPICe+ form for company incorporation.

Payment of Fees: Pay the requisite fees for company registration. The cost may vary depending on the type and capital of your business.

Verification and Approval: Once your documents are verified, the RoC will grant you a Certificate of Incorporation (COI). Congratulations, your company is now officially registered!

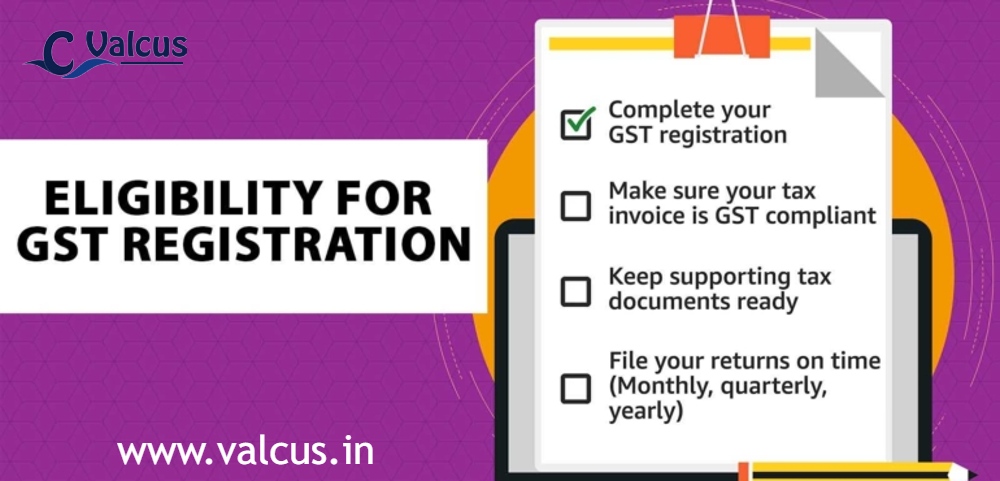

GST Registration in Delhi: The Key to Tax Compliance

Goods and Services Tax (GST) is a unified tax system applicable to businesses across India. To legally operate your business in Delhi, you must obtain GST registration. Follow these simple steps to get your GST registration in Delhi:

Determine Eligibility: First, check if your business qualifies for GST registration. Businesses with an annual turnover exceeding a specified threshold are required to register.

Collect Documents: Gather essential documents, including PAN, Aadhar, business registration documents, bank details, and proof of business address.

GST Registration Portal: Visit the official GST portal and fill out the GST registration application form. Ensure you have all the necessary information and documents at hand.

Verification and Validation: After submitting the application, the details provided are verified by the GST authorities. Any discrepancies may lead to a request for additional information or documents.

ARN and Registration Certificate: Once your application is verified and approved, you will receive an Application Reference Number (ARN) via email. Shortly after, you will receive your GST registration certificate.

In conclusion, registering your company and obtaining GST Registration in Delhi are crucial steps on your path to business success. While the processes might seem daunting, breaking them down into simple, manageable steps and seeking the assistance of professionals can make the journey much smoother. Service providers like Valcus can be your trusted partner in this endeavor, ensuring that your business complies with all legal requirements and operates smoothly in the dynamic capital city of Delhi. So, take that first step, get registered, and set your business on the path to success!

.jpg)